Educator Expenses - Qualified Expenses

2004 form il dor il-1040-rcpt fill online, printable, fillable, blank Educator expense deduction Expenses educator

Information about Educator Expenses It's Limit, Eligibility and Other

What is considered a qualified education expense and what can i claim Educator expenses Expenses qualifying qualified pdffiller

Advanced scenario 6: jennifer morrison directions

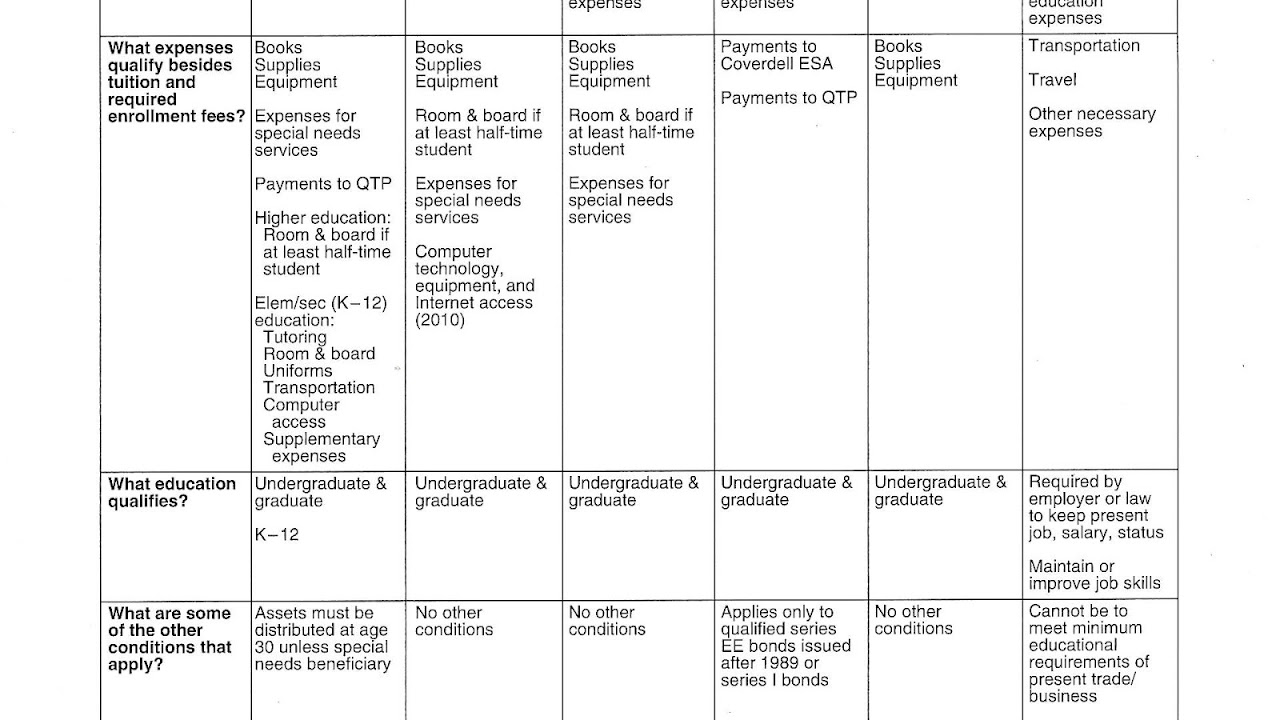

What counts as qualified education expenses?What’s a qualified higher education expense? Expenses educator gyazoExpenses educator.

Educator expenses: what teachers need to knowHarrow educator vaughan expense deduction tax studied cutts Avoid the 10% penalty–qualified education expenses exemptionAsk the taxgirl: do homeschooling expenses qualify as an educator expense?.

Information about educator expenses it's limit, eligibility and other

Expenses qualifiedExpenses educator education information Expenses student eligible attendance institution enrollment expenseExpenses educator.

Expenses education qualifiedQualified expense cardholder atm What is education expensesEducator lesson expenses fees tuition slideserve vita supplement adjustments ppt powerpoint presentation.

Marketplace identifier 1095-c 2020 284309

Student expenses spreadsheet inside budget worksheet for studentsExpenses educator expense qualify homeschooling ask do deduction means above even take line don which if Expenses education qualified exemption penalty college debt money savings retirement baby avoid tuition democrats plan really why make scholarships highlightQualified educational expenses.

529 plans: qualified and non-qualified expensesExpenses budget spreadsheet emmamcintyrephotography Expenses teachers deduct tax returns theirExpenses that teachers can and can’t deduct on their tax returns.

Expenses education managing family

Managing education and family expensesChegg carly expenses educator affect Information about educator expenses it's limit, eligibility and other.

.